indiana excise tax alcohol

For beer they pay an extra 11 and one-half cents. To regulate the sale possession and distribution of tobacco products.

U S Alcohol Tax And Fet Reform Overproof

Motor Fuel - MFT.

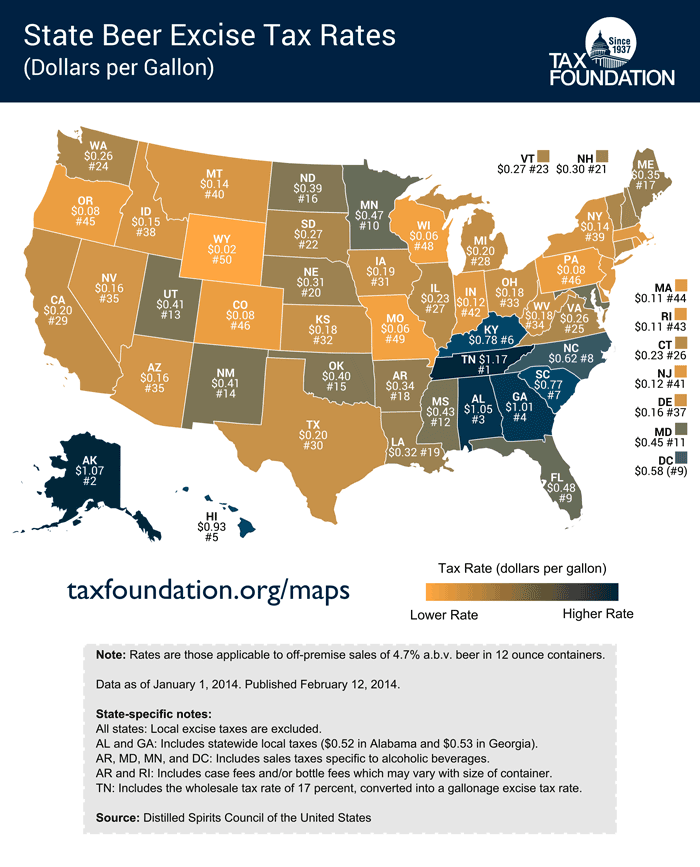

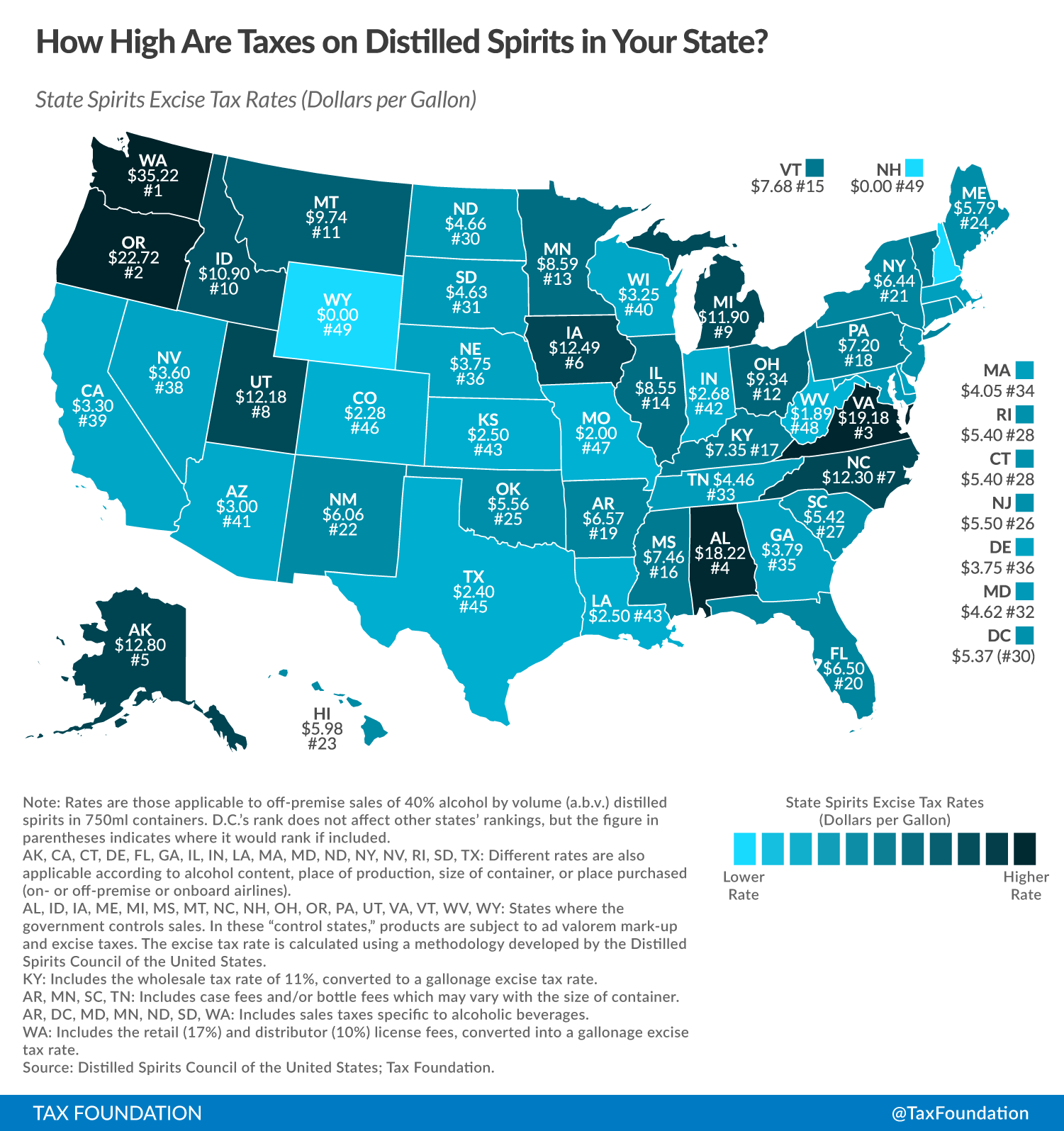

. Indiana Alcoholic Beverage Permit Numbers Section B. Missouri taxes are the next lightest at 200 a gallon followed by Colorado 228 Texas 240 and Kansas 250. The Alcohol and Tobacco Commission ATC is happy to provide guidance and direction on the process for submitting applications and obtaining permits for the sale distribution and manufacture alcohol tobacco e-liquid or type II gaming.

The federal government collects approximately 1 billion per month from excise alcohol taxes on spirits beer and wine. Federal excise tax rates on various motor fuel products are as follows. Consumers pay 268 per gallon 637 per 9 L cs and 053 per 750ml bottle.

Supporting schedule to be filed with ALC-W. School for the Deaf Indiana. Alcohol Type Indicate the alcohol type being invoiced.

Not part of tax calculation. In 2019 excise taxes on alcohol amounted to 10 billion. To regulate and limit the manufacture sale possession and use of alcohol and alcoholic beverages.

Gallons Returned to Winery from Schedule ALC-DWS-S Transaction Type C. Please visit the Electronic Filing for Alcohol Taxpayers webpage for electronic filing information. Taxes Finance.

Excise taxes on tobacco are implemented by every state as are excises on alcohol and motor fuels like gasoline. Total Gallons Sold from Schedule ALC-DWS-S Transaction Type A. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services.

Excise tax data continuity. Budget Agency State. Studies show that a 10 increase in the price of distilled spirits would likely reduce distilled spirits.

Alcohol. Transaction Type Indicate the transaction type being reported A B or C. The general purposes of the Alcohol Tobacco Commissions work as defined by law are.

Have a State Excise Officer speak at my school or organization. Increase alcohol excise taxes. There are three options for electronically filing.

Bond Bank Indiana. Task Force on Community Preventive Services recommendation. Vessels subject to excise tax include motorboats registered in another state and operated on Indiana waters for more than 60 consecutive days or moored on the Indiana part of Lake Michigan for more than 180 days.

The ATC cannot provide legal or business advice. Tax-exempt Gallons Sold from Schedule ALC-M-S Transaction Type A. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon.

Gallons Received During Reporting Month from Schedule ALC-W-S Transaction Type A. Spirits excise rates may include a wholesale tax rate converted to a gallonage excise tax rate. A liquor product with a volume of 15 or less alcohol is considered to be a wine.

Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. File a complaint against an alcohol or tobacco business. Vehicle Sharing Excise Tax - VSE.

Indianas general sales tax of 7 also applies to the. The Indiana State Excise Police is the law enforcement division of the Alcohol Tobacco Commission. Alcohol Taxes in Indiana.

Alcoholic Beverage Wholesalers Excise Tax Return. When it comes to assigning tax amounts things can get complicated especially since beer wine and spirits are all taxed at different amounts. Gallons Withdrawn for Sale or Gift in Indiana.

Ethics Commission Indiana State. 3 rows Indiana Liquor Tax - 268 gallon. Indiana has a state excise tax.

Look up an alcoholic beverage permit online. INtax Indianas free online tool to manage business tax obligations includes alcohol taxes. Excise Tax Calculation Wine Tax rate 047 1.

Aviation Fuel AVF. North America Sep 01 2021. Monthly Excise Tax Return for Indiana-Based Farm Wineries.

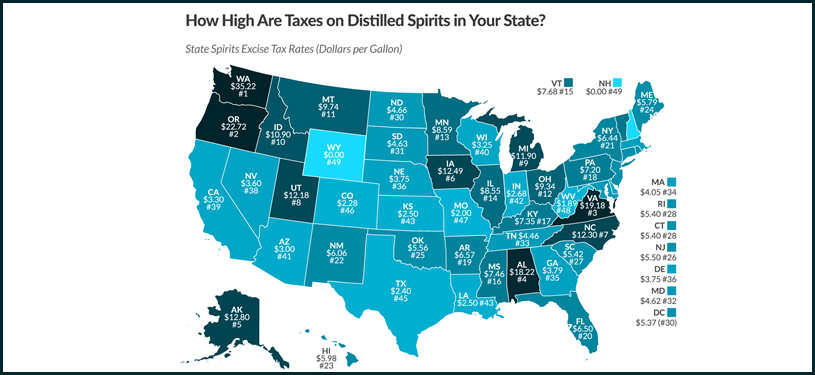

Indiana law requires owners of vessels that are operated used docked or stored in Indiana to pay the boat excise tax. Our mission is to provide quality service and to protect the morals and welfare of the people of the State of. Like many excise taxes the treatment of spirits varies widely across the states.

Can you buy alcohol in Indiana on Sunday. Get a copy of the Indiana alcohol and tobacco laws. State Form Number.

Attend a certified server training program in my area. Gallons Returned to Manufacturer from Schedule ALC-M-S. In addition to or instead of traditional sales taxes cigarettes and other tobacco products are subject to excise taxes on both the Indiana and Federal levels.

Gallons Taken Out of Bond. Taxes on spirits are significantly higher than beer and wine at 1350 per gallon while beer is taxed at 18 per barrel and wine is 107-340 per gallon. And for wine the pay an extra 47 cents.

Other Indiana Excise Taxes. Case andor bottle fees which can vary based. Special Fuel - SFT.

Other Tobacco Products - OTP. Excise Police Indiana State 10 Articles. Excise Tax Calculation Wine Tax rate 047 1.

Physical AddressCityStateZIP Indiana Tax Identification Number Mailing AddressCityStateZIP Telephone Number Business Web Address Indiana Alcoholic Beverage Permit Numbers Section B. As of January 1 2012 Indianas excise tax per gallon of beer was 012 13. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1.

Tax-exempt Gallons Sold from Schedule ALC-DWS-S Transaction Type B. Auditor of State. Beginning July 7 2022 no new registrations will.

Transporter Tax - TRP. State Excise police officers are empowered by statute to enforce the laws and rules of the Alcohol Tobacco Commission as well as the laws of the State of Indiana. How multiple systems endangered tax data integrity.

Use W for wine L for liquor B for beer and C for cider. Follow New articles New articles and comments. To protect the economic welfare health peace and morals of the people of this state.

Yes retailers including grocery stores convenience stores and liquor stores are permitted to sell alcohol on Sundays. Studies show that a 10 increase. Gasoline Use Tax - GUT.

Apply for employment as an Indiana State Excise Police officer. Supporting schedule to be filed with ALC. The price of all motor fuel sold in Indiana also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration.

In general spirits are taxed 1350 per proof gallon which is defined as a gallon of liquid that is 50 alcohol. Alcohol Beverage Applications Forms. Gallons Returned to ManufacturerImporter or Destroyed from Schedule ALC-W-S Transaction Type B.

Although electronic filing is required paper forms with instructions are available so customers can visualize what is required. Business Web Address Indiana Alcoholic Beverage Permit Numbers Section B. Increase alcohol excise taxes.

Tax-exempt Gallons from Schedule ALC-FW-S Transaction Type A.

By The Numbers Virginia Ranks 3rd Highest On Alcohol Taxes Virginia Thecentersquare Com

State Alcohol Excise Tax Rates Tax Policy Center

These States Have The Highest And Lowest Alcohol Taxes

2019 Liquor Taxes By State Distilled Spirit Distillation Alcohol Content

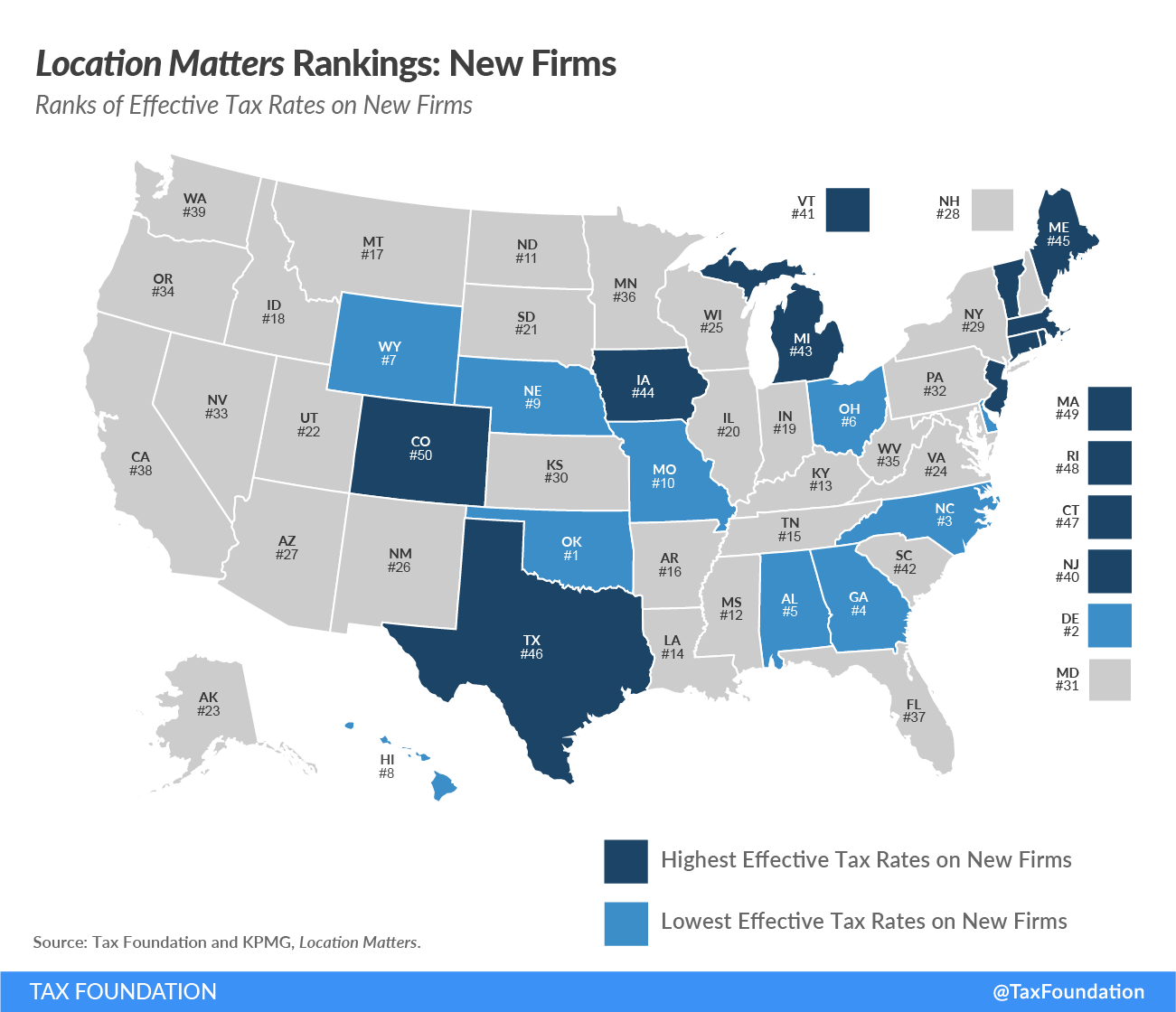

Missouri Tax Reform Missouri Tax Competitiveness

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Criminalization Without Representation Learn Liberty Https Www Youtube Com Watch V Cgfphozayjilibertarian Party Of Indiana Learning Liberty Indiana

When Did Your State Enact Its Gas Tax Tax Foundation

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

U S Alcohol Tax Revenue 2026 Statista

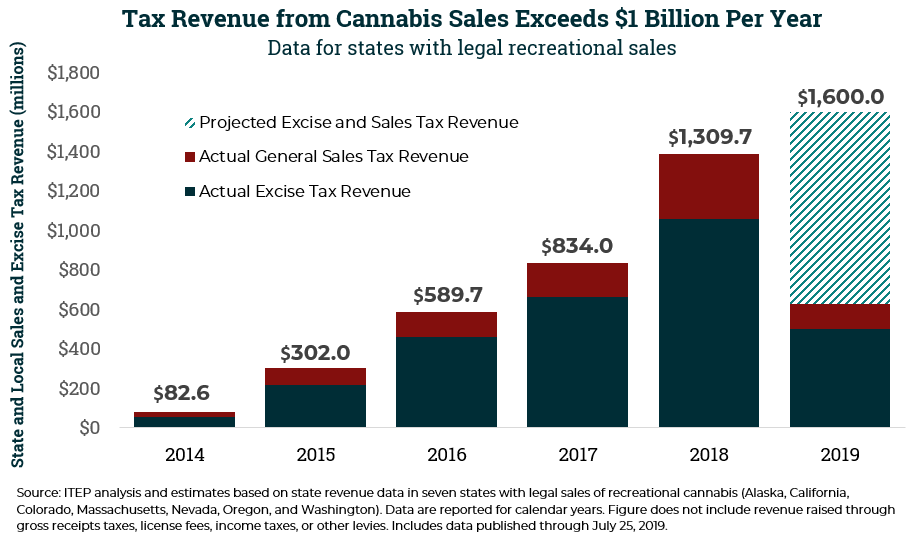

State And Local Cannabis Tax Revenue On Pace For 1 6 Billion In 2019 Itep

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Criminalization Without Representation Learn Liberty Https Www Youtube Com Watch V Cgfphozayjilibertarian Party Of Indiana Learning Liberty Indiana

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation